Achieving the Elusive 800 Credit Score: Tips and Insights

Discover practical tips to reach an 800 credit score while maintaining a balanced financial life.

Have you ever wondered what it takes to hit that magical 800 credit score mark? You're not alone! Achieving and maintaining a high credit score can open doors to better financial opportunities, like lower interest rates and easier loan approvals. But how does one embark on this journey without feeling overwhelmed? Let’s dive into some insights and strategies that can help you get there.

The Journey to an 800 Credit Score

First off, let’s clear one thing up: reaching a perfect score isn’t just for financial gurus. It’s about smart money management and patience. Here are some practical tips to bring you closer to that coveted number:

- Consistent Payments: Make sure you pay all your bills on time. Set up reminders or automatic payments to avoid any late fees.

- Credit Utilization: Keep your credit card balances low compared to your limits. Aim for under 30% utilization to positively impact your score.

- Diverse Credit Mix: Having a variety of credit types, like installment loans and revolving credit, can show lenders you're capable of managing different kinds of debt.

- Regular Monitoring: Check your credit report regularly for errors. Tools like annual credit reports can be valuable here.

A Balanced Approach to Financial Health

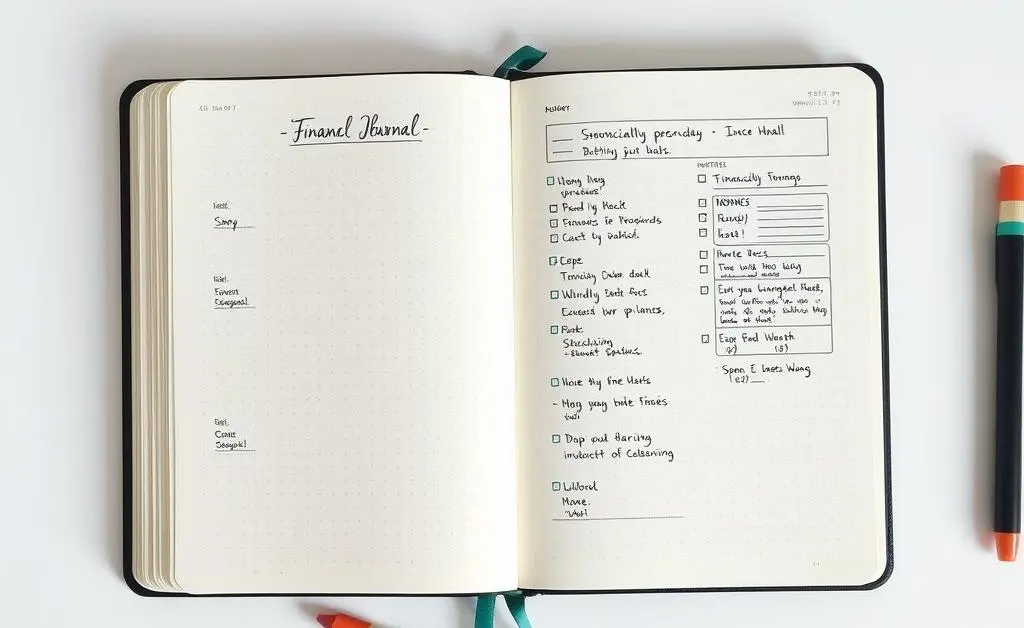

Now, let’s switch gears with a quick story. Imagine Alex, a 30-something professional who loves coffee and traveling. Alex started taking small steps every month, like using a bullet journal to set financial goals. By consistently paying down debts and keeping a close eye on credit utilization, Alex saw gradual improvements. In just a few years, Alex reached an 800 credit score, celebrating with a trip (paid off in cash, of course!).

Remember, striving for a perfect credit score doesn't mean you need to sacrifice everything fun in life. It's about balance. You can enjoy life’s little pleasures while being mindful of financial commitments.

What If You Hit a Bump?

Life happens, and sometimes things don't go as planned. If you miss a payment or unexpectedly need to max out a credit card, don't panic. Use this as a learning opportunity. Focus on getting back on track, ensuring next month’s payment is on time, and gradually paying down balances.

Wrapping It Up

Reaching an 800 credit score isn’t just about achieving a number; it’s about fostering healthier financial habits. With time, persistence, and a touch of patience, you can enjoy the perks of a high credit score.

So, what's your next step on your credit journey? How do you plan to become more financially savvy? Feel free to share your thoughts and strategies!