Demystifying Tax Policies for Young Adults: A Simple Guide

Navigate tax policies effortlessly with our practical guide for young adults.

Ever feel like deciphering tax policies is akin to learning a new language? You're not alone, and the good news is it doesn't have to be that way. If you're a young adult trying to make sense of your fiscal responsibilities while being gleefully attached to your parents financially, this guide is for you.

Understanding Fiscal Attachment

Fiscal attachment tends to sound more complicated than it really is. In simple terms, it's the attachment to your parent's financial status for tax purposes, often a scenario for students or young adults early in their careers. This status can offer a range of tax advantages, but it requires some nuance to navigate.

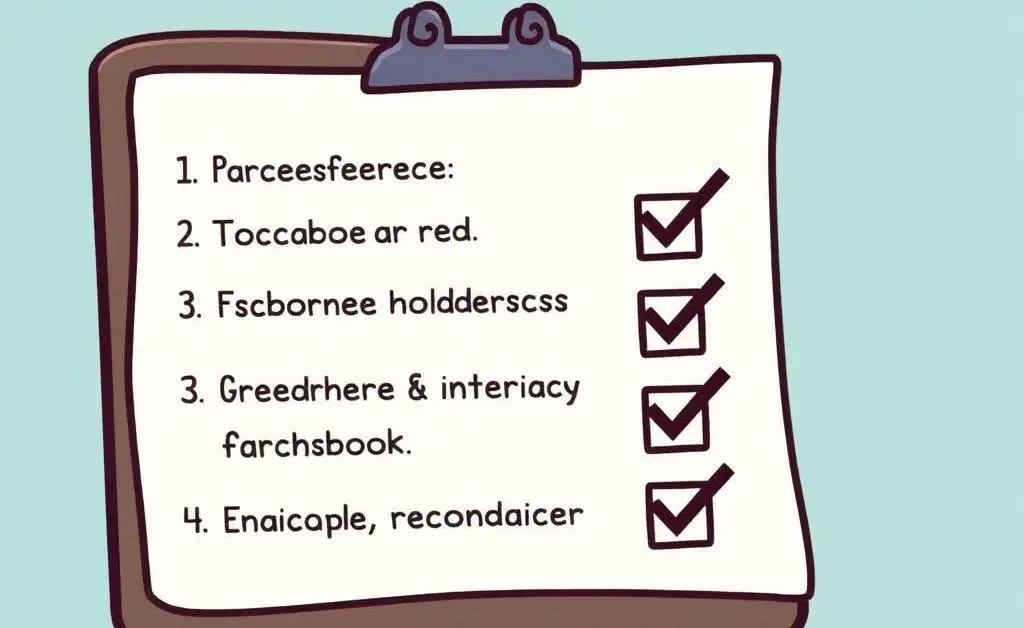

Checklist for Navigating Fiscal Attachment:

- Know your dependency status: Determine if you're still considered a dependent for tax purposes.

- Understand the tax implications: Learn about how your income affects your parent's tax bracket.

- Explore tax benefits: Are there education credits or deductions available?

- Consult with a tax advisor: Always a wise option to clarify personal circumstances.

Practical Tips for Young Adults

When it comes to taxes, a little preparation can go a long way. Imagine this: You're seated at your desk, cup of coffee in hand, and your financial documents spread out before you. With a few well-organized steps, you're turning what seemed daunting into a task conquered.

Executing a Simple Tax Plan:

Budget early and often. Put away money not just for taxes but general financial growth. Engage with reliable resources that demystify jargon. And crucially, tolerate the learning curve – it gets less intimidating with time!

Growing Beyond Dependency

As life progresses, so do the responsibilities and eventual detachment from fiscal attachment status. It signifies not just a financial shift, but an exciting new chapter. With proactive management and a hint of curiosity, the transition becomes a seamless blend into financial independence.

By setting clear financial goals and executing plans, the future holds a promise not just of compliance but of personal financial growth.

As you delve into your tax journey, what's one aspect you're most curious about or find challenging? Share your thoughts – every insight could lead to smoother roads ahead.