Navigating Insurance Claims: How Long is Too Long to Wait?

Explore the timeline for filing insurance claims and why acting sooner is better.

Have you ever wondered how long you can wait before filing an insurance claim? It’s a common question, especially after a stressful event. Knowing the timelines is crucial not only for peace of mind but also to ensure your claim is processed without hiccups.

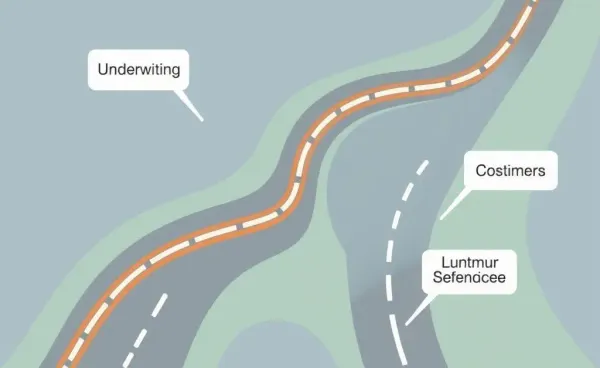

Why Timing Matters in Insurance Claims

When something unexpected happens, like a fender bender or storm damage, our first instinct might be to take a breather. But delaying your insurance claim can be risky for several reasons:

- Policy Requirements: Most insurance policies have a specific window to file a claim, usually ranging from 30 to 90 days.

- Evidence Collection: Waiting too long might complicate gathering the necessary documentation and photographs.

- Memory Fades: Details can get fuzzy over time, potentially affecting the information you provide.

Understanding Your Policy's Timeframe

Let's take Mike’s story. After a minor car accident, he procrastinated, thinking he’d review his insurance details later. Weeks turned into months. When he finally contacted his insurer, he learned he had missed the filing deadline, leaving him without support for repairs.

Avoid Mike’s mistake by checking your policy’s requirements. Here are a few steps to help:

- Review your policy for specific claim timelines.

- Contact your insurance provider promptly for guidance.

- Keep thorough records such as photos, receipts, and any third-party information.

What If You've Waited?

If you've found yourself contemplating the wait, act now. Insurance companies are accustomed to handling claims, and they’ll guide you through the process, even if you're past the ideal filing time. Honesty and documentation are your allies.

Remember your policy’s timeframes and prepare to answer some questions regarding the delay. It may not guarantee an outcome, but it’s worth a shot.

Timing and Communication

In the world of insurance claims, communication is key. By staying proactive, keeping in touch, and understanding your policy, the process can be less daunting, even in emotionally charged situations.

As you reflect on your own experiences or consider how to handle future incidents, I’d love to know: How do you manage the complexity of insurance paperwork? Share your thoughts and let’s empathize and learn together.