Understanding Credit Card Issuer Policies: What You Need to Know

Learn about credit card issuer policies, including why some limit the number of cards you can hold.

Ever wondered why some credit card companies seem to have a limit on how many cards you can have? You're not alone, and understanding these policies can help you better navigate your personal finance journey.

Why Do Card Issuers Have these Policies?

Credit card companies, like Capital One and others, sometimes enforce a cap on the number of credit cards you can hold at one time. This might sound puzzling at first—after all, isn’t issuing more cards a win for them? Well, not always.

Card issuers impose these limits for a few reasons:

- To manage financial risk and avoid overextending credit to a single individual.

- To ensure customers are managing existing debts responsibly.

- To maintain a healthy ratio of open versus closed credit accounts.

Looking at the Fine Print: How Does This Affect You?

Let me share a quick story to highlight this. My friend Jane was a meticulous planner who loved optimizing her credit rewards. She applied for a new card every time she saw a good sign-up bonus. One day, she got a surprisingly curt letter: "We regret to inform you..." Yep, she'd hit the CapOne card limit!

While slightly inconvenient, these limits forced Jane to reevaluate her credit strategy and prioritize better offers. It was a blessing in disguise!

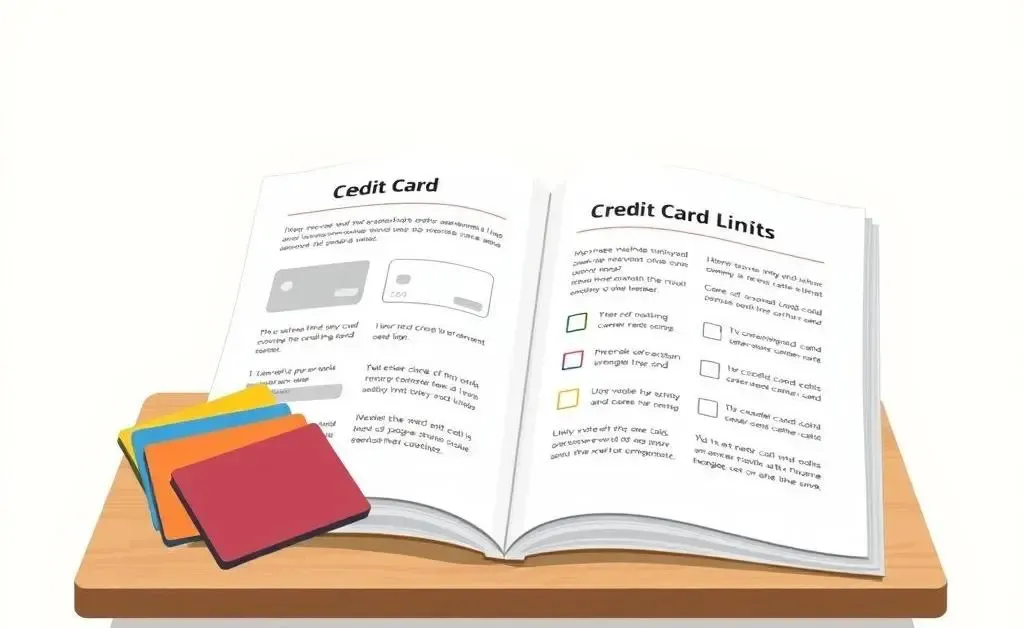

How to Plan Around Credit Limits

Here are some tips to keep in mind:

- Understand the card limits of each of your issuers. They differ greatly.

- Prioritize cards that offer the best benefits and rewards aligned with your habits.

- Consider using a financial app to monitor your credit utilization.

Can You Increase Your Limit?

Good news: Sometimes you can increase your card limit! By demonstrating responsible credit use and improving your credit score, you're more likely to get better terms.

So if you're ever concerned about being maxed out in your card collection, remember that building a meaningful credit history works magic.

Conclusion: Staying Informed is Key

Credit cards are handy tools in our financial toolbox, but being informed about different issuer policies can help you make strategic choices. What’s your go-to strategy for optimizing credit use?