Understanding Stock Buybacks: What They Mean for You

Discover the ins and outs of stock buybacks and their impact on your personal investments.

Hi there! It's always so nice to sit down and have a chat about something that's been getting quite a bit of attention in the financial world—stock buybacks. So, what exactly are stock buybacks, and how might they influence your investment decisions? Let’s dive in together.

What Are Stock Buybacks?

Simply put, a stock buyback occurs when a company decides to purchase its own shares from the stock market. This act reduces the number of shares available, potentially increasing the value of the remaining shares. Imagine a pie where each slice is now just a bit bigger because a few slices have been taken away.

Why Do Companies Buy Back Their Stocks?

Great question! Companies might initiate buybacks for several reasons:

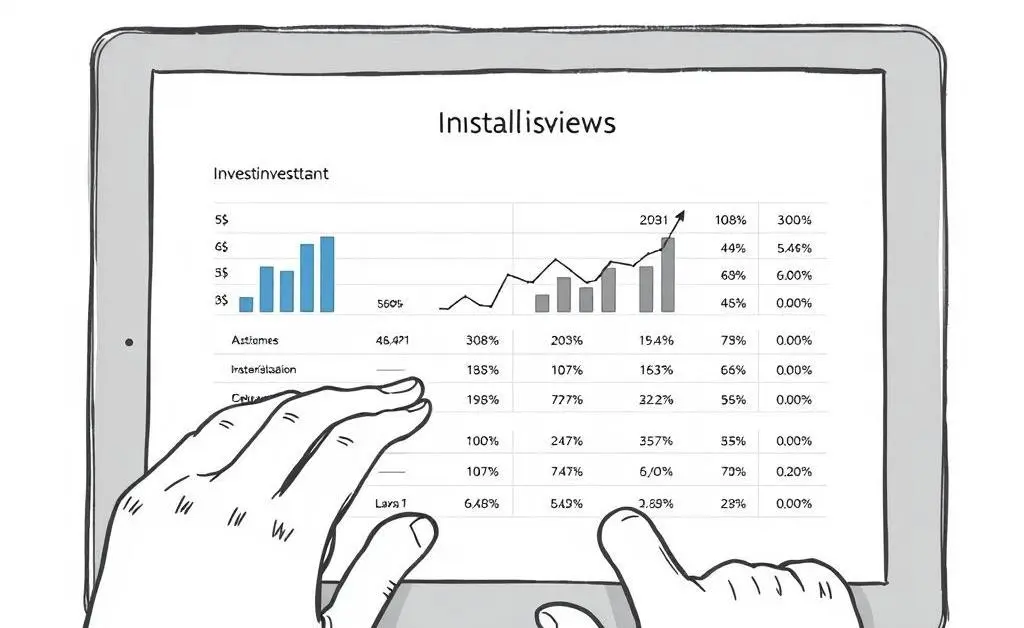

- Belief in Undervaluation: They think their stock is undervalued and want to invest in themselves.

- Improving Financial Ratios: Fewer shares can mean higher earnings per share (EPS), a valuable metric for investors.

- Returning Value to Investors: It's a way of rewarding shareholders, similar to dividends.

Implications for Investors

As an investor, you might be wondering how stock buybacks affect you. Well, it largely depends on the company's motivations and how they impact share value.

For instance, if a buyback is driven by a genuine belief in undervaluation and not just to boost financial metrics artificially, it could be a positive sign. Over time, your shares might increase in value without you doing anything at all—just like magic! But remember, not all buybacks are created equal, and it's crucial to dig a bit deeper.

Should You Be Concerned?

It's natural to have questions about whether stock buybacks are beneficial in the long run. While they might offer positive short-term gains, they could also imply that the company doesn't see better growth opportunities to invest in.

Reflect and Strategize

So, next time you hear about a company conducting a stock buyback, approach it with curiosity. One delightful aspect of investing is that it’s not just about numbers; it's a narrative, one where you play an active role.

How does the story of stock buybacks resonate with your personal investment strategy? Could the insights impact your next move in your portfolio?

In the end, maintaining a thoughtful and reflective approach will help guide your financial journey. Until next time, happy investing!