Understanding SWIFT Transfers: Navigating International Banking with Ease

Demystify international wire transfers with insights on SWIFT transfers and timing.

Ever wondered why international transfers can sometimes feel like they take a lifetime, while other times they're shorter than waiting for your morning coffee? You're not alone. Understanding the intricacies of SWIFT transfers can help ease your worries and maybe even save you some money along the way.

What Is a SWIFT Transfer?

In the realm of international banking, a SWIFT transfer is akin to sending a financial letter via express mail between banks all over the world. It uses a standardized code system, known as SWIFT codes, to ensure that funds get from Point A to Point B safely and securely. It's the gold standard of global banking communication.

Factors That Influence Transfer Timing

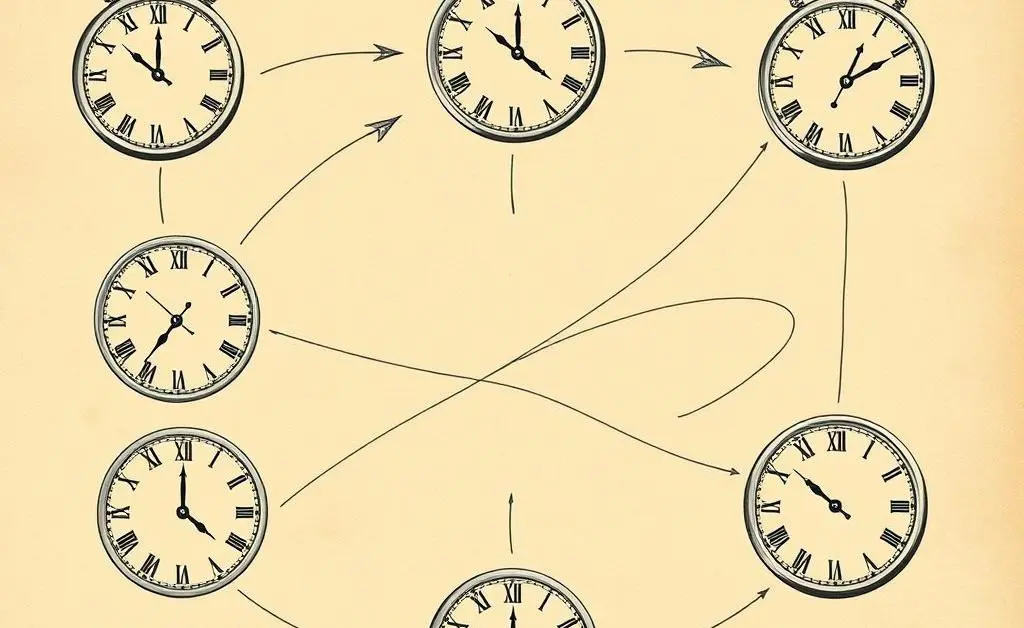

If you’ve ever done a dance of anticipation waiting for your funds to land into an account, you’ll be pleased to know that a few elements play a pivotal role in how quickly a SWIFT transfer completes:

- Time Zone Differences: Because banks operate at different times around the globe, your transfer might catch a bank on a holiday or closed hours.

- Weekends and Bank Holidays: Just like most of us, banks like to take a day off too. Expect delays if your transfer coincides with a weekend or a holiday.

- Intermediary Banks: Sometimes funds need a friendly nudge from intermediary banks, which can add an extra day or two to the process.

Tales from the Transfer Trenches

Let me share a story about my friend Jake, who needed to send money to his sister studying abroad. It was supposed to be a straightforward transfer to help her out with rent. Jake got everything done on a Friday afternoon, blissfully unaware of the bank holiday on the other side of the world. The funds languished for three whole days in cyberspace. The moral of Jake’s story? Timing is key!

Smart Tips for Faster Transfers

Strategically planning your SWIFT transfers can mean the difference between a painless transaction and an anxiety-inducing wait.

- Check Time Zones: Always be aware of the local banking hours of both the sender and receiver banks.

- Avoid Weekends and Holidays: Try to send transfers on Monday or Tuesday for the quickest service.

- Consult Your Bank: Some banks offer expedited service for a fee, worth considering if timing is crucial.

So, what experiences have you had with international transfers? Drop a comment below; I'd love to hear your stories!