Understanding Tax on Savings Account Interest: A Simple Guide

Learn how to pay taxes on savings interest with ease. A friendly guide to navigate interest earnings like a pro.

Ever found yourself staring at your savings account wondering, "Do I really have to pay taxes on this interest?" You’re not alone! Many people feel a bit hazy on how interest is taxed until April creeps up, and it's time to file a tax return.

Why Is My Savings Account Interest Taxed?

Simply put, the interest your savings account earns is considered income, much like your salary. And yep, that means Uncle Sam wants his share. Once your account starts banking over a certain threshold, it’s party time—for the IRS.

How Much Tax Will I Pay?

Your interest income is taxed at your ordinary income tax rate, which might have you searching for “ordinary income tax rate” online right now. But don’t sweat it; this isn't as daunting as it sounds.

- Check your tax bracket to know what percentage you’ll need to give back with that extra earned interest.

- Remember to gather all your 1099-INT forms from your bank to ensure you report the exact interest earned.

- Short on savings? The interest threshold means not everyone has to file, so double-check if your earnings need reporting.

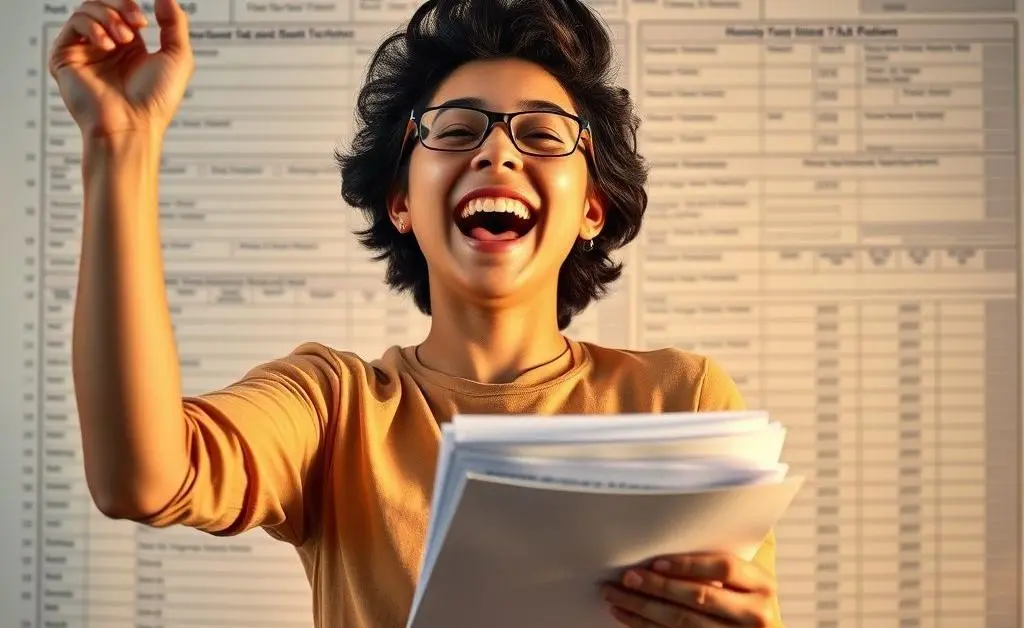

A Quick Personal Tale

Once upon a tax season, I too was baffled by my interest income. But after taking a night to dive into some light reading with a side of comfort food, voila—I realized I wasn’t alone. Millions filed just like me, and it wasn’t as perplexing as I had imagined.

Filing It Right

For most people, filing taxes on interest is simply a matter of totaling up and inputting your earnings. If your interest is minimal, the process should be as breezy as your favorite song on a summer day.

If you're serious about growth, consider tools that might save you tax. Open a Tax-Free Savings Account (TFSA) if you're eligible, thus potentially avoiding tax on future interest!

Over to You

Have you nailed the best way to handle your interest income taxes, or is the IRS still your final exam panic? We’d love to hear your story or tips. Let’s chat in the comments below!