Unlock the Power of Points: Navigating Rewards Programs with Savvy Strategies

Discover smart tips to maximize your rewards points and avoid common pitfalls. Are you making the most of your rewards?

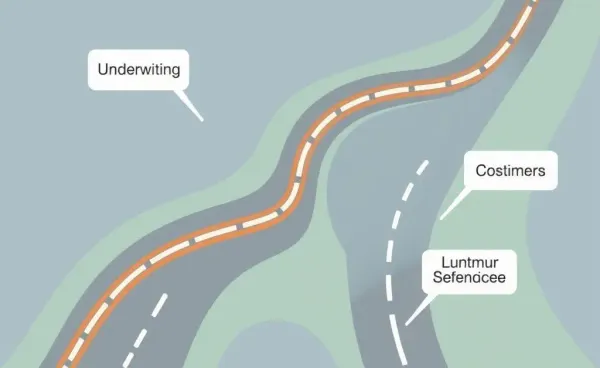

Have you ever felt like the world of rewards programs is one big treasure hunt? While the allure of earning points on everyday purchases is captivating, the path to truly maximizing those rewards can seem like decoding hieroglyphics. Let's delve into the art of navigating these programs and ensure your points work for you, not against you.

Understanding Your Rewards Landscape

First things first: take stock of your current credit card offers and loyalty programs. It's easy to get swept up in the excitement of new offers without understanding what you've already got. Here's a quick checklist to get started:

- List all your credit cards and associated rewards programs.

- Note each card's reward rate, fees, and redemption options.

- Identify which programs overlap or complement each other.

Once you've mapped out your rewards landscape, you can start strategizing like a pro.

Strategic Tips to Maximize Rewards

Now that you've got a grip on your cards, it's time to focus on maximizing the benefits. Here are some practical tips:

1. Align Spending with Reward Bonuses

Many cards offer bonus points on specific categories like groceries or travel. Evaluate where you spend most and align your spending to maximize these bonuses.

2. Timing Is Everything

Plan your big purchases around promotional periods. For instance, some cards offer bonus points for shopping during holiday seasons or card anniversaries.

3. Stay Aware of Redemption Traps

Not all points are equal. Look out for redemption options that devalue your points. It's often best to redeem for travel or experiences rather than low-value gift cards.

As a side note, I once got carried away with a double-points weekend and bought more pastries than I could eat. Moral of the story? Evaluate if a purchase really fits your needs or if it's just the thrill of points driving you.

Navigating Potential Pitfalls

Amidst all the excitement, remember that rewards programs can have downsides if not managed carefully:

1. Avoid the Temptation of Overspending

It's easy to overspend when you're chasing rewards. Always keep your budget in balance.

2. Mind the Fees

Some cards have high annual fees that can negate the rewards if you aren't using the benefits fully.

3. Stay Organized

Keep track of points expiry dates and card renewals. Removing clutter from your wallet - and your mind - can save you money and stress.

Your Adventure Awaits

With careful plotting, you can navigate the rewards maze effectively. What's the best treasure you've discovered in your rewards journey?