Why Vanguard's Fees Are Worth Watching: A Friendly Dive into Cost-Effective Investing

Explore Vanguard's fee structure and why even a slight change can impact your investments.

Ever wondered why all the talk about Vanguard's fees gets investors so animated? It's not just about fractions of a percent—they can make or break your investment returns over the long haul. Let's dive into why keeping an eye on fees is a savvy move for any investor.

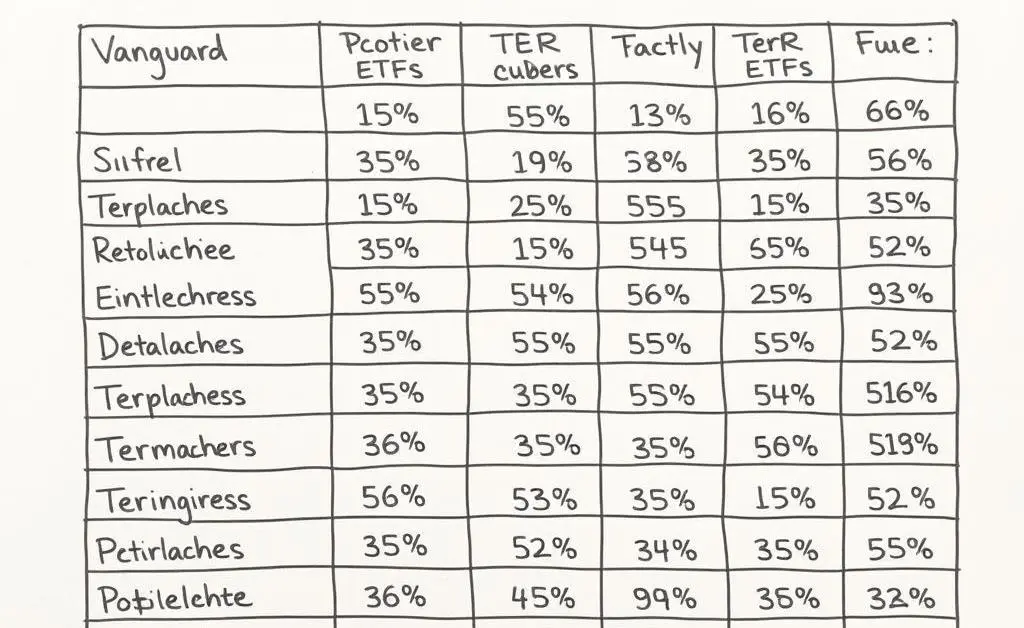

Understanding TER: The Small Fee with a Big Impact

When it comes to investing, the Total Expense Ratio (TER) might seem like a tiny detail. But think of it like how a small hole in a dam can eventually lead to a flood. A one-percent difference in fees might not sound like much, but it compounds over time, making a significant dent in your potential gains.

Why Vanguard's Fee Structure Matters

Vanguard has long been the hero in the world of low-cost investing, often setting the bar for competitive fees against which others are measured. Their aim: democratize investing by making it affordable for everyone.

Let's say you're planning to invest in a Vanguard ETF. With a TER of, for example, 0.25%, it promises low-cost access to markets. In comparison to other options that could charge upwards of 1%, the savings in fees alone could be substantial over decades. That's some serious lunch money, or in investing terms, retirement fund padding!

What Happens If Vanguard Lowers Its Fees?

Imagine a scenario: you're sipping coffee with a friend who’s been investing in Vanguard for years. They casually mention, "What if Vanguard drops its fees again?" suddenly, your mind races through possibilities.

Even a small reduction could enhance growth, providing a potentially significant impact, especially as markets shift and your investment grows. To stay ahead, investors often weigh such potential changes against their portfolio strategies.

What Should You Be Watching?

- Keep an eye on fee announcements from Vanguard to identify opportunities to optimize your investments.

- Monitor how fee changes might impact specific ETF offerings, especially if you’re already invested.

- Understand your portfolio's makeup to ensure it aligns with your financial goals even as fees fluctuate.

The world of investing, much like life, is unpredictable, and adaptability is key. So, keep informed, stay flexible, and be ready to pivot when changes arise in fee structures or other critical areas of your financial journey.

In Closing: Your Fee-Savvy Future

Whether you're a seasoned investor or just starting, understanding and keeping tabs on fees like those at Vanguard is part of building a healthy financial future. After all, every little bit saved today can mean a lot more tomorrow.

So, what are the fees you prioritize in your investment decisions, and how do they shape your strategy? I'd love to hear your thoughts in the comments below!